Reversal overview

Reversals look to capitalize on arbitrage opportunities provided by skewed options pricing. Risk reversal strategies have defined risk and profit. A reversal consists of selling a call and buying a put for long stock positions or buying a call and selling a put for short stock positions. All options have the same expiration date.

Reversal market outlook

A reversal strategy is used to create a risk-free profit. Reversals secure a defined profit and limit risk when entered. Reversals use the credit from writing an option to help offset the cost of holding the long option. The short option will limit the profit potential, while the long option protects from an unfavorable move in the underlying stock.

Risk reversals may be used on long or short stock positions and are entered for a guaranteed small credit. The credit received at entry is the guaranteed profit with no risk, as the shares of stock will be closed when the in-the-money option is exercised. While the profit is guaranteed, it is limited to the original credit received, and the investor will not experience additional profit if the stock continues higher or lower.

How to set up a Reversal

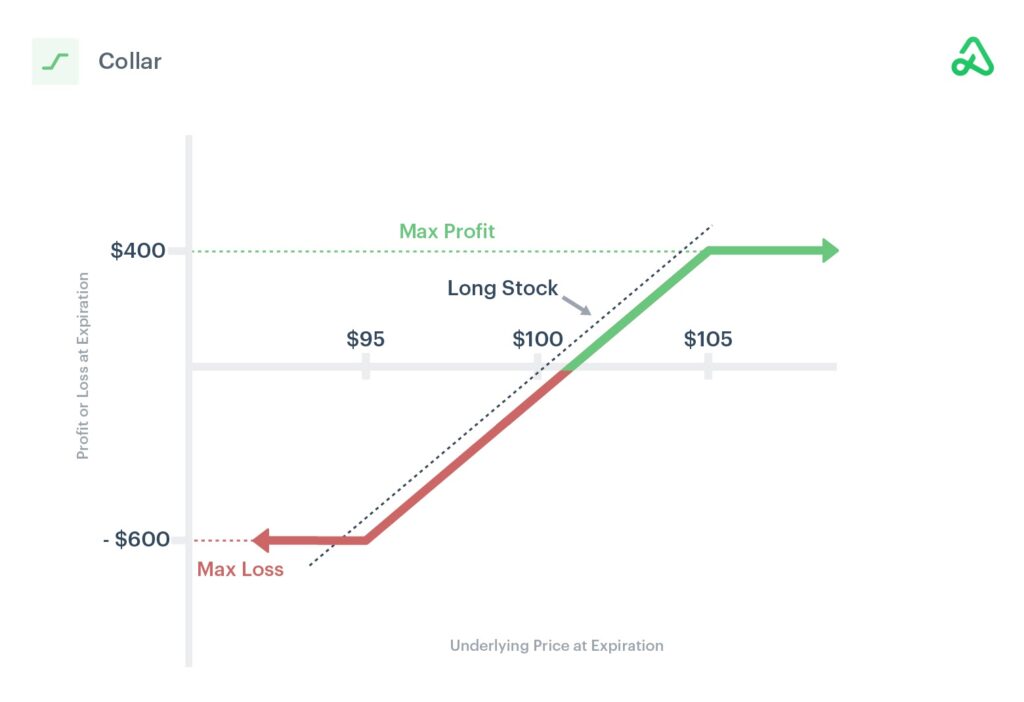

A reversal is created by purchasing and selling opposing at-the-money options contracts with the same expiration date. Reversals are similar to collars in their composition. If an investor is long a stock, a short reversal is created by selling a short call option at the price the stock was purchased, and buying a long put option at the same strike price, much like a collar strategy. If an investor is short stock, simply reverse the mechanics: a short put option is sold and a long call is purchased to create a long reversal.

The long leg components of the reversal provide protection if the stock moves against the investor. The short legs help offset the cost of buying the long options but limit profits if the stock moves in the desired direction.

Reversal payoff diagram

The payoff diagram for a reversal is a straight horizontal line based on the credit received to enter the position. The strategy takes advantage of skew in options pricing, when available, while protecting against downside risk.

For example, if a stock is owned at $100, a reversal may be created by buying-to-open (BTO) a $100 put and selling-to-open (STO) a $100 call with the same expiration date. This would only be advantageous if a credit is received. Therefore, the short call would have to collect more money than the long put. If $1.00 was earned for completing the transaction, a profit of $100 would be the trade outcome. If the stock is above the strike price of $100, the short call will be exercised and sell the 100 shares of stock. Conversely, if the stock price is below the strike price of $100, the long put will be exercised and sell the 100 shares of stock.

If a stock has increased since the position was initiated, a reversal could be created above the purchase price to secure a profit. The strike price of the options would guarantee the exit price.

For example, if a stock purchased at $100 is trading for $110, and a costless reversal could be entered at $105, a $500 profit would be guaranteed, because the long stock position would be sold at $105 regardless of where the underlying stock price is at expiration. The reversal would protect against future downside price movement. However, the profit would be capped at the $105 strike price.

Image of reversal payoff diagram showing guaranteed profit

Entering a Reversal

Entering a risk reversal involves buying and selling options with the same strike price and expiration date, typically at the price the stock was originally purchased or higher. If long shares of stock are owned, a buy-to-open (BTO) order is placed for a long put and a sell-to-open (STO) order is placed for s short call. If an investor is short shares of stock, the order is reversed: purchase a long call and sell a short put. The goal is to collect a credit at entry based on skew in the option’s pricing. This will guarantee a profit, as the options will automatically cancel out the stock position at expiration.

Exiting a Reversal

Reversal strategies are typically held until expiration. At expiration, one of the two options will expire in-the-money, and the other will expire worthless and out-of-the-money. Because the options are opened at the price of stock ownership, the in-the-money option will automatically be exercised and close the stock position. The reversal trade is opened for a credit, and that credit will remain as profit.

Time decay impact on a Reversal

Time decay does not impact a reversal strategy during the trade but may impact the pricing at entry. Because the strategy depends on a skew in options pricing to be profitable, an investor will want to identify a scenario where theta works in favor of the short option being sold.

Implied volatility impact on a Reversal

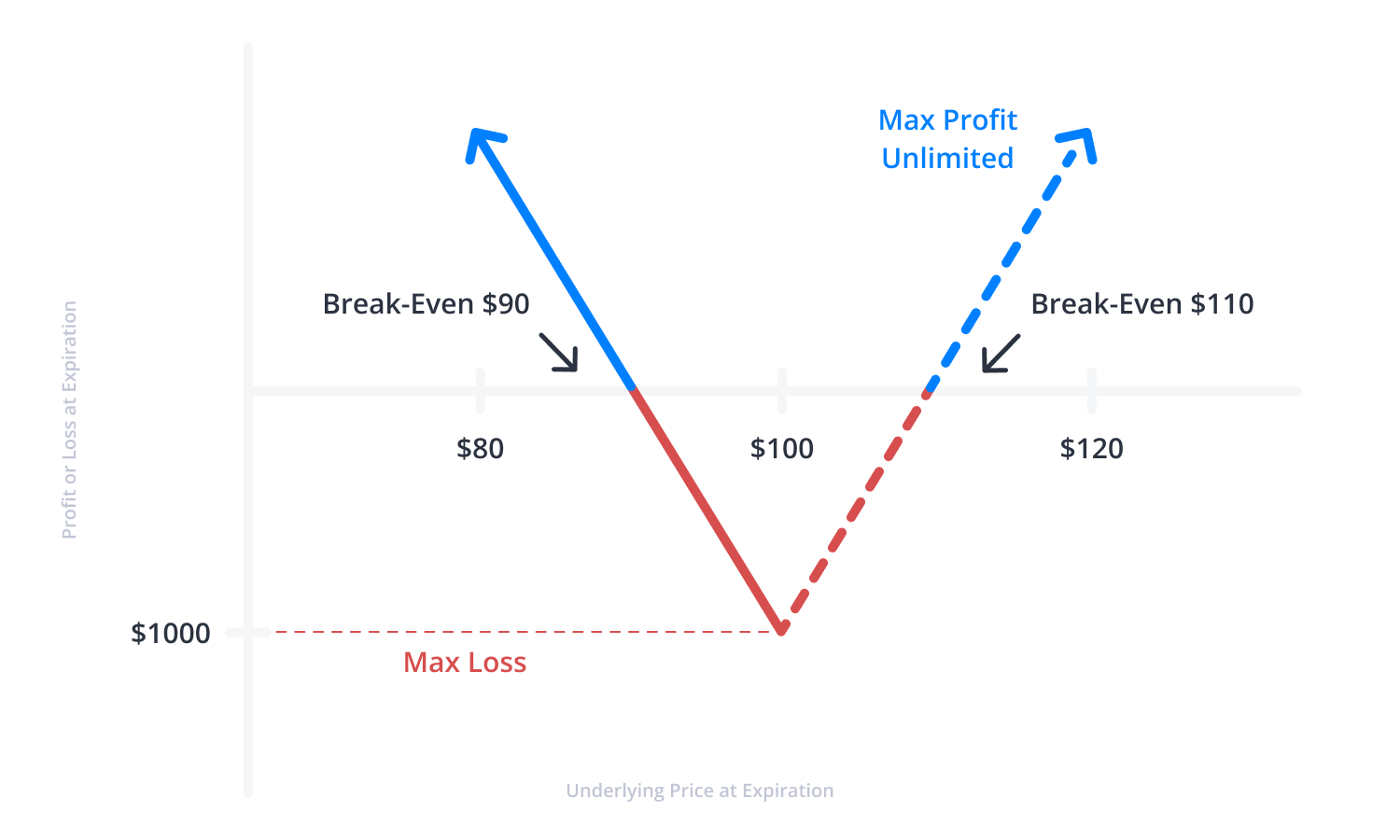

Implied volatility does not impact a reversal strategy during the trade but may impact the pricing at entry. Because the strategy depends on skew in options pricing to be profitable, an investor will want to identify a scenario where implied volatility works in favor of the short option being sold. This will typically occur when the market anticipates a move in one direction is more likely than the other, which will result in higher pricing for those options premiums.

For example, if a stock is owned at $100, the at-the-money options will be priced according to the market’s belief that the underlying asset is more likely to move up or down. The $100 call may be worth $3.00, while the $100 put is only worth $2.00. This is because implied volatility in the future tends to lead to a move up in the stock price. An investor would then enter a reversal by selling the call and buying the put, thereby guaranteeing a $100 profit whether the stock moves up or down.

Adjusting a Reversal

A reversal position may be adjusted if the trade can be extended for more credit. This may be possible as the options approach expiration if the original skew in pricing still exists. If the price of the underlying stock is unchanged, the same position could be opened for a later expiration date. If the underlying stock price has changed, and a new reversal can be opened at-the-money for credit, an investor may choose to extend the trade and continue receiving credit.

Rolling a Reversal

Reversals can be rolled to a later expiration date if the original position can be closed and reopened for more credit. The roll could occur at the same strike prices or adjusted up or down to reflect a change in the underlying stock price, but only if additional credit is collected. This may be accomplished by simply closing the existing position and opening a new position for a later expiration date.

Hedging a Reversal

Reversals are not typically hedged because the strategy is a hedge for an underlying stock position. A reversal is a tool to lock in profit and avoid downside risk, so further hedging is unnecessary. The position already has a strictly defined profit and loss outcome.

FAQs

What is the difference between a collar and a risk reversal strategy?

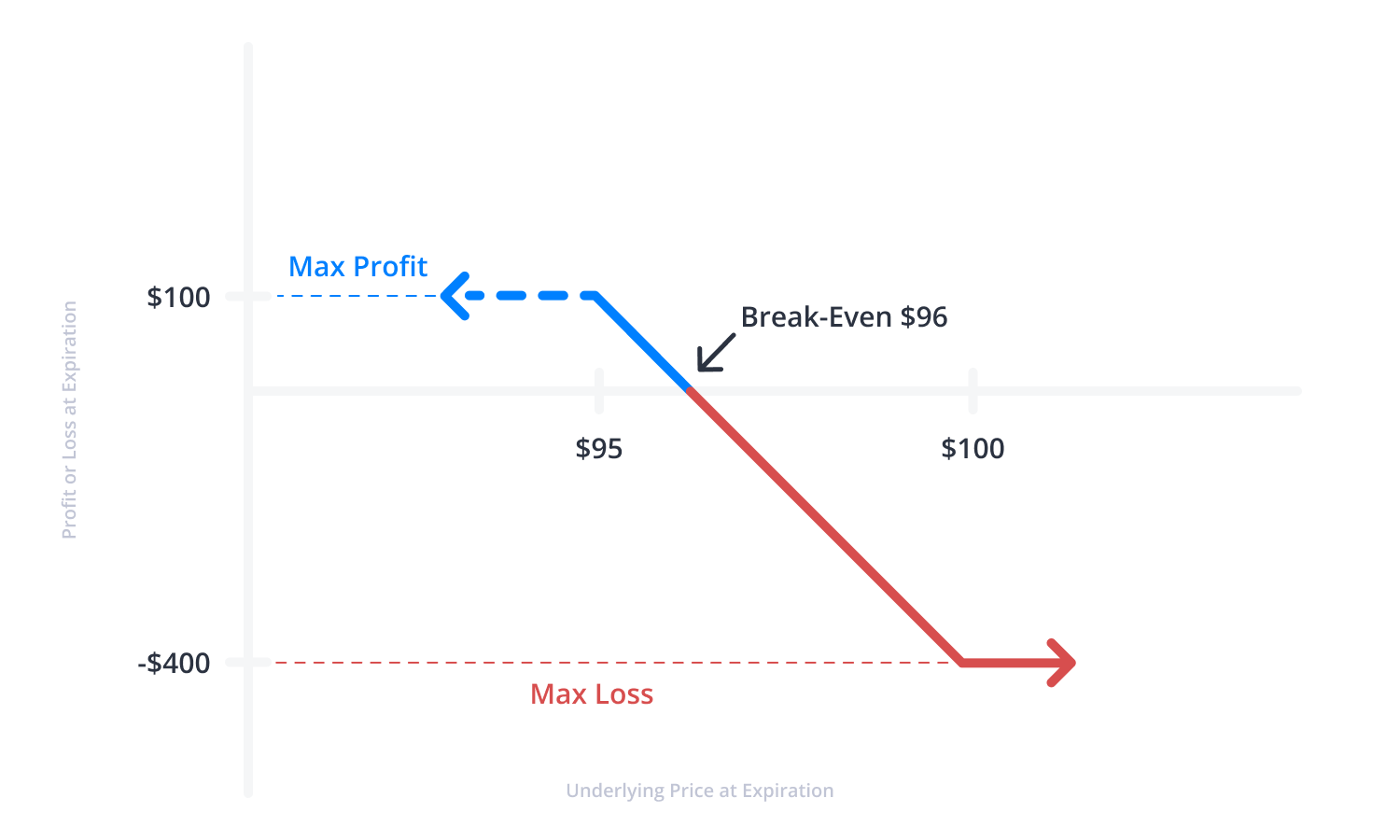

A collar strategy is a multi-leg options strategy combining a covered call and protective put. Selling the covered call will result in a credit that can be used to offset the cost of purchasing the protective put.

What is an example of an options risk reversal?

If you collect $1.00, a $100 profit is guaranteed if the position is held until expiration (less any brokerage fees + commissions). If the stock is above the strike price of $100, the short call will be exercised and sell the 100 shares of stock. Conversely, if the stock price is below the strike price of $100, the long put will be exercised and sell the 100 shares of stock.