Iron Butterfly overview

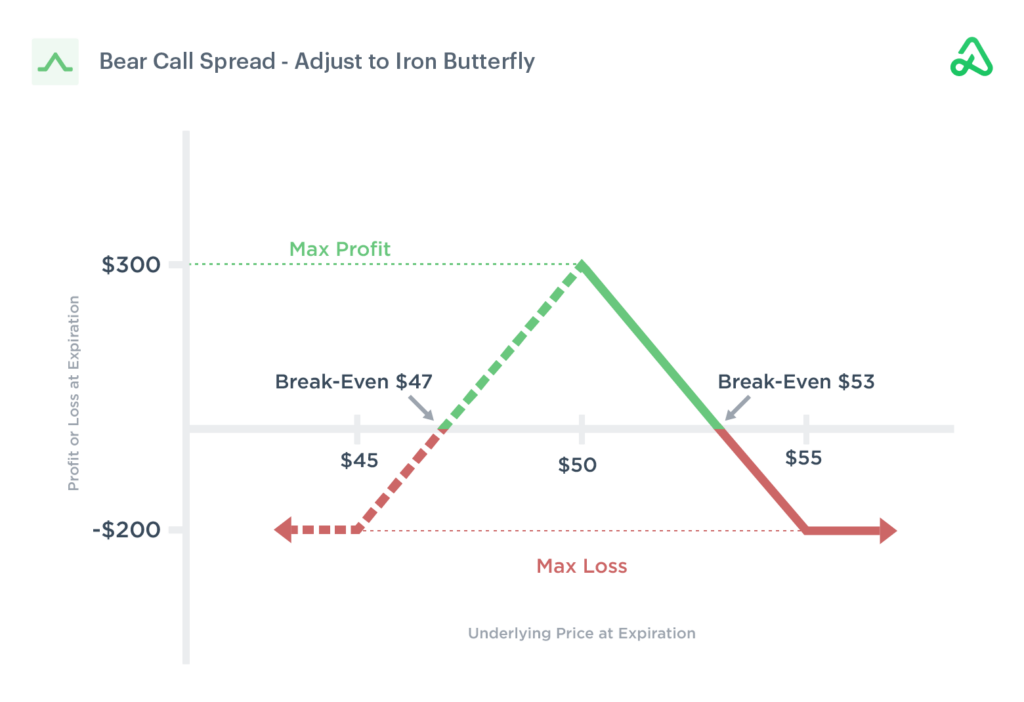

The iron butterfly options strategy consists of selling an at-the-money short straddle and buying out-of-the-money options “on the wings” with the same expiration date to create a risk-defined position.

Iron butterfly trades look to take advantage of a drop in volatility, time decay, and little or no movement from the underlying asset.

Iron Butterfly market outlook

Iron butterflies are market neutral and have no directional bias. Iron butterflies capitalize on a decrease in volatility and minimal movement from the underlying stock to be profitable. A credit is received when the position is opened. The iron butterfly spread width defines the maximum risk for the strategy. The risk is limited to the spread width minus the premium received. An investor would initiate an iron butterfly when the expectation is the stock price will stay range-bound before expiration and implied volatility will decrease.

How to set up an Iron Butterfly

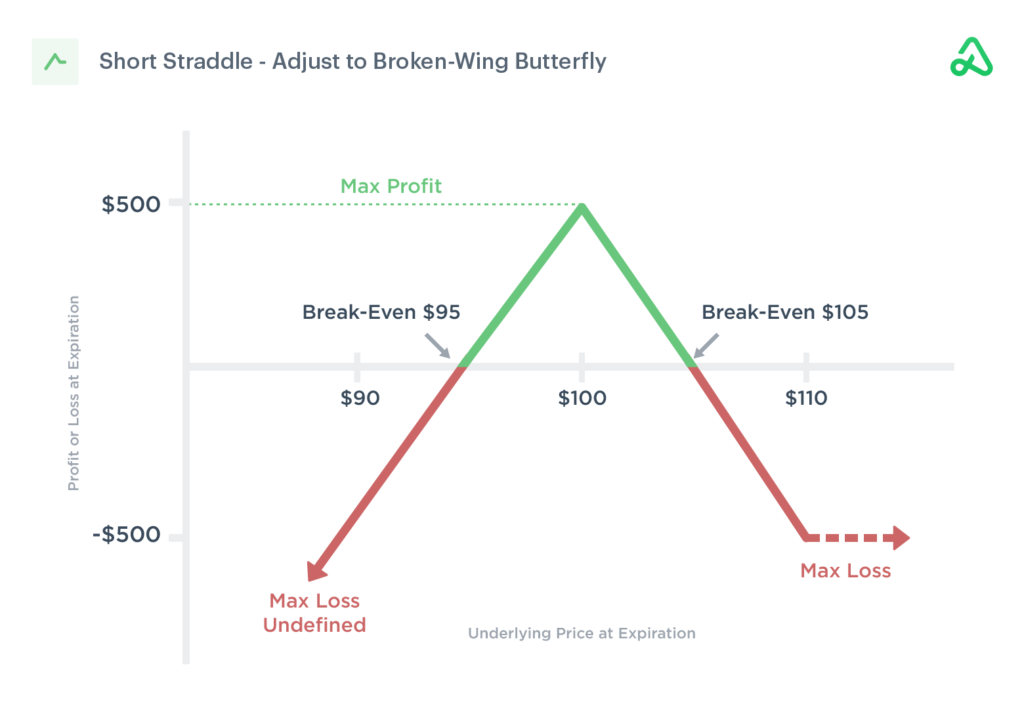

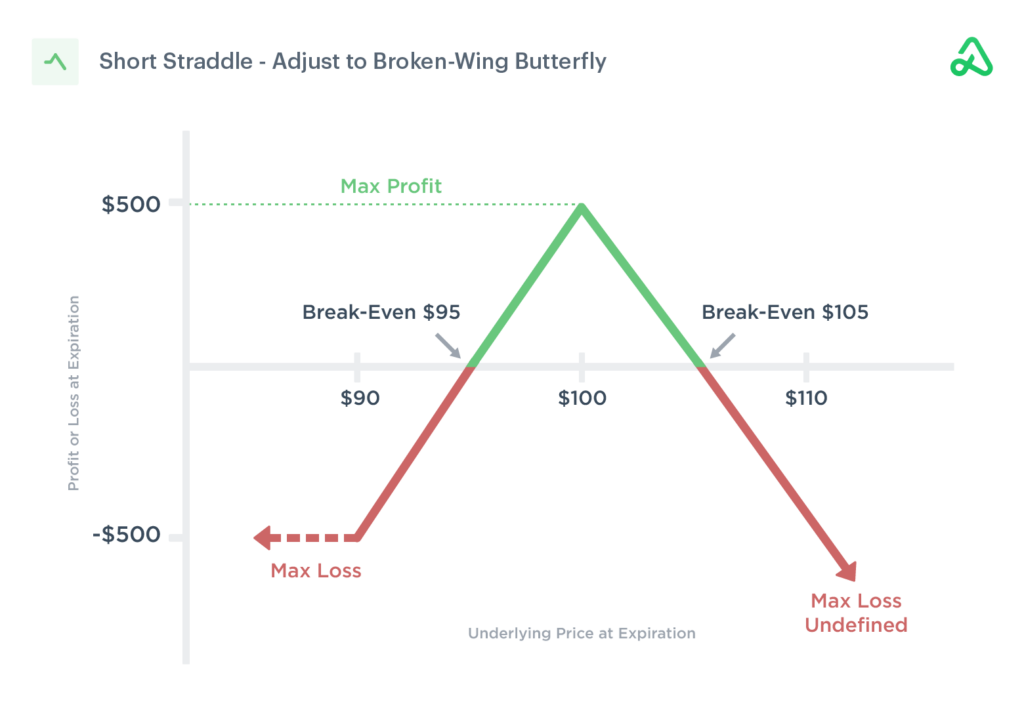

Iron butterflies are essentially a short straddle with long option protection purchased above and below the short strikes to limit risk. This creates a bear call credit spread and bull put credit spread centered at the same short strike price with the same expiration date. The combined credit of the spreads defines the maximum profit for the trade. The maximum risk is defined by the spread width minus the credit received.

The wider the spread width between the short option and long option, the more premium will be collected, but the maximum risk will be higher.

Iron butterflies are typically sold at-the-money of the underlying asset. However, they can be entered above or below the stock price to create a bullish or bearish bias.

For example, if a stock is trading at $105, an iron butterfly centered at $100 would be a bearish position because the underlying asset’s price must decline before expiration for the position to realize maximum profit.

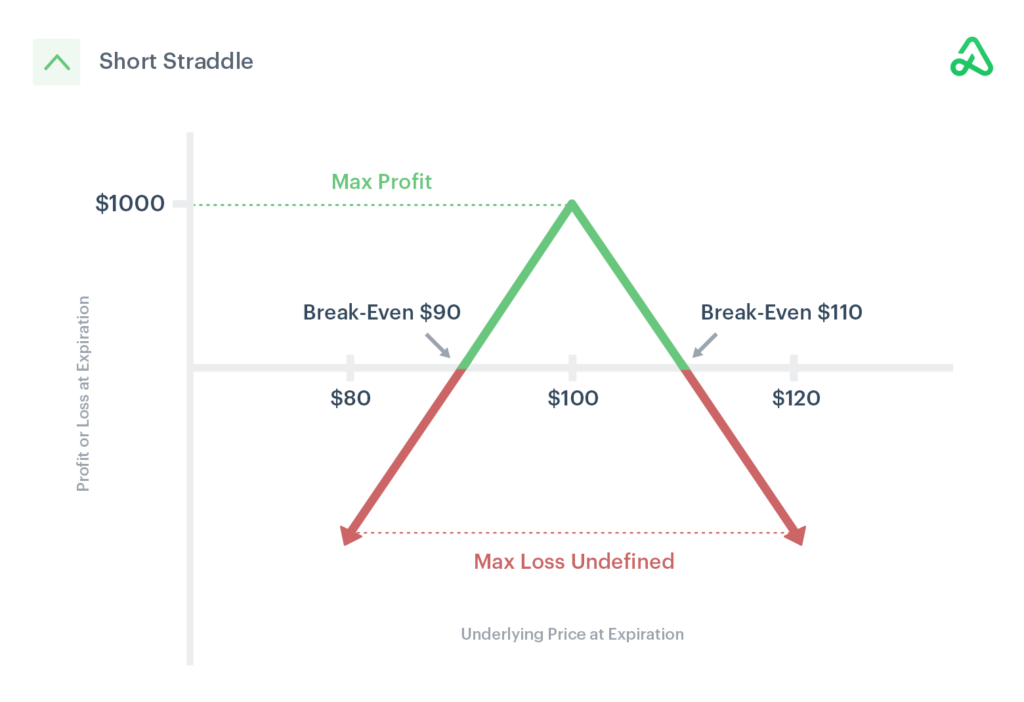

Iron Butterfly Payoff Diagram

The iron butterfly gets its name from the payoff diagram, which resembles the body and wings of a butterfly. The profit and loss areas are well defined with an iron butterfly. A credit is collected when entering an iron butterfly. The initial credit received is the maximum profit potential. If the underlying price is above or below one of the long strike prices at expiration, the maximum loss will be realized. The break-even points are determined by the total credit received, above or below the short options.

For example, if an iron butterfly is opened for a $5.00 credit, the break-even price will be $5.00 above and below the short strikes.

Any time before expiration, there may be opportunities to exit the position for a profit. This is accomplished by exiting the full position, exiting one spread, or buying back only the short options.

Technically, for an iron butterfly to achieve maximum profit, the underlying stock price would need to close at-the-money of the short options. Because this is unlikely, iron butterflies are typically exited early at a predetermined profit target or days until expiration. For a profit to be realized, the stock price must stay relatively stable or implied volatility decreases.

Image of iron butterfly payoff diagram showing max profit, max loss, and break-even points

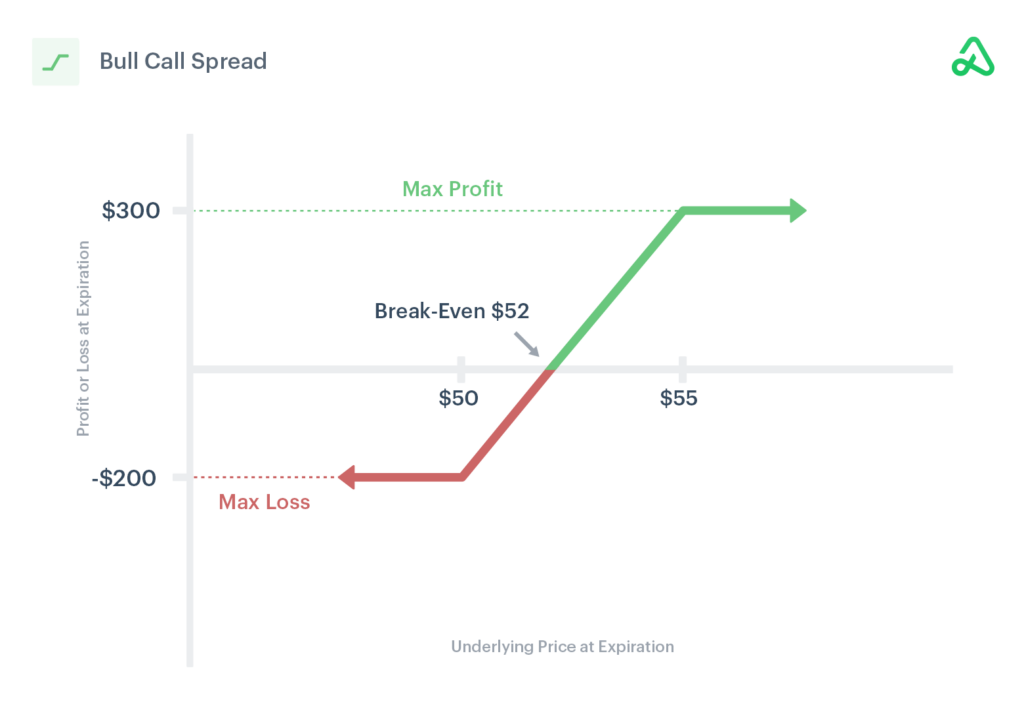

Entering an Iron Butterfly

To create an iron butterfly, sell-to-open (STO) a short straddle, buy-to-open (BTO) a call option above the straddle’s strike price, and buy-to-open a put option below the straddle’s strike price. All option contracts have the same expiration date.

For example, if a stock is trading at $100, a call option and put option could be sold at the $100 strike price, with a long call purchased at the $110 strike price and a long put purchased at the $90 strike price. This would create a $10 wide iron butterfly. If the credit received to enter the trade is $5.00, the max profit would be $500 and the max loss would be -$500.

- Buy-to-open: $90 put

- Sell-to-open: $100 put

- Sell-to-open: $100 call

- Buy-to-open: $110 call

Higher volatility will equate to higher options prices. The longer the expiration date is from the trade’s entry, the more the options will cost, and more premium will be collected when the position is opened.

Exiting an Iron Butterfly

An iron butterfly looks to capitalize on time decay, minimal price movement in a stock, a drop in volatility, or a combination of all three. At expiration, one of the short options will likely be in-the-money and at risk of assignment, so the position must be closed if assignment is to be avoided.

Any time before expiration, the position can be exited by closing the entire iron butterfly, one spread, or just the short strikes. If the options are purchased for less money than they were sold, the position will result in a profit.

Time decay impact on an Iron Butterfly

Time decay, or theta, works to the advantage of the iron butterfly strategy. Every day the time value of an options contract decreases. Ideally, the underlying stock experiences minimal movement, and theta will exponentially lose value as the position approaches expiration. The decline in value may allow the investor to purchase the options contracts for less money than initially sold.

Implied volatility impact on an Iron Butterfly

Iron butterflies benefit from a decrease in implied volatility. Lower implied volatility results in lower option premiums. Ideally, when an iron butterfly is initiated, implied volatility is higher than it is at exit or expiration. Future volatility, or vega, is uncertain and unpredictable. Still, it is good to know how volatility will affect the pricing of the short options.

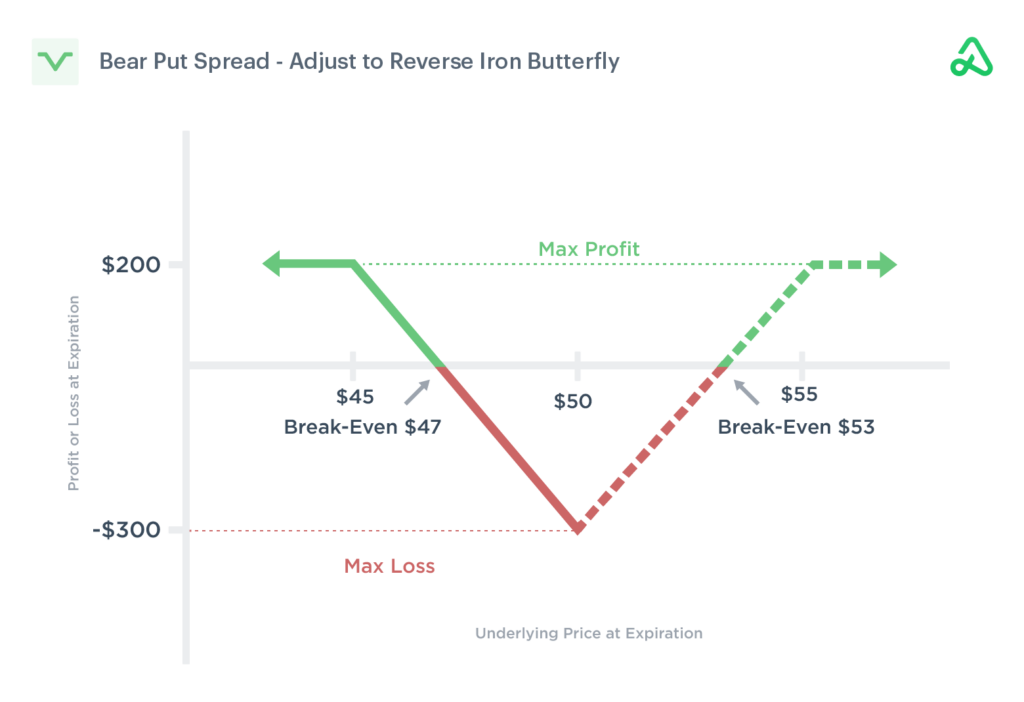

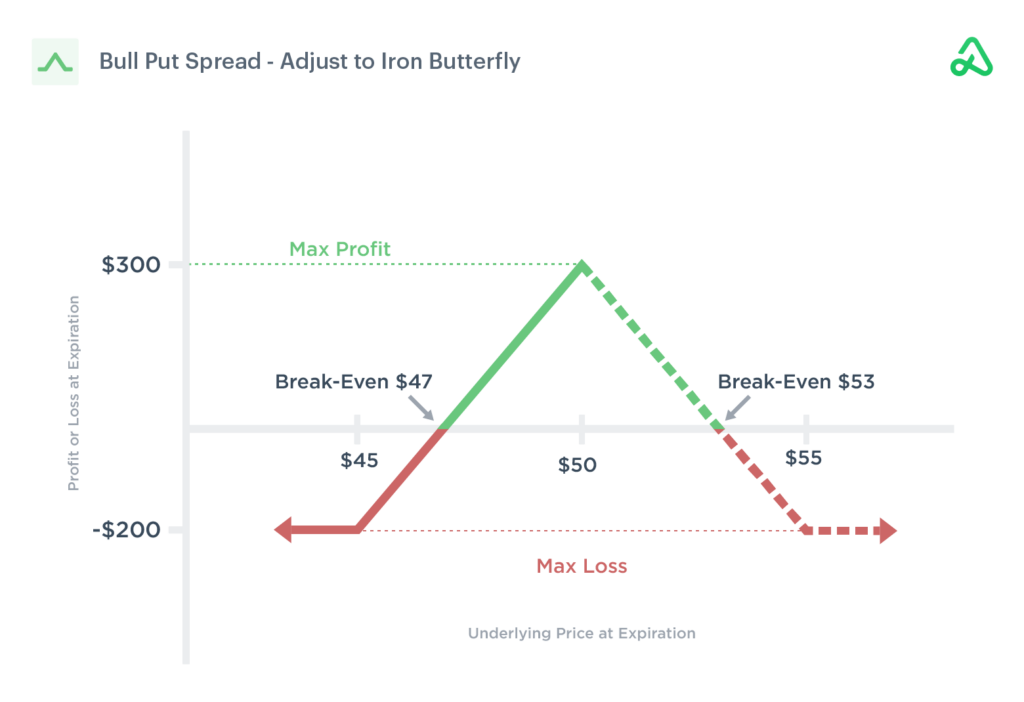

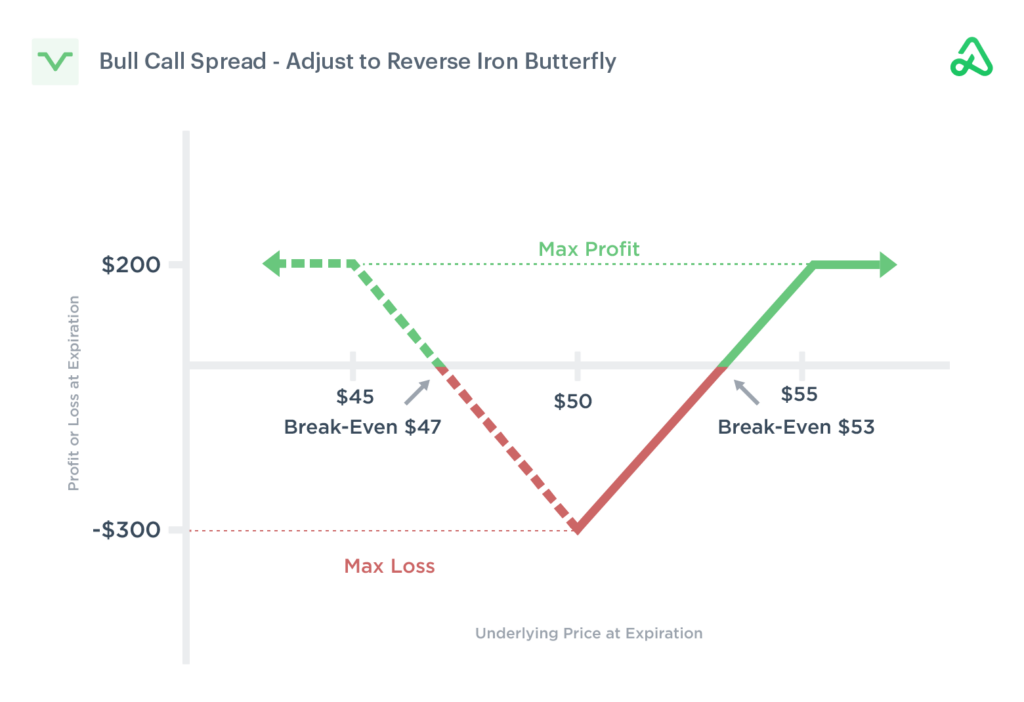

Adjusting an Iron Butterfly

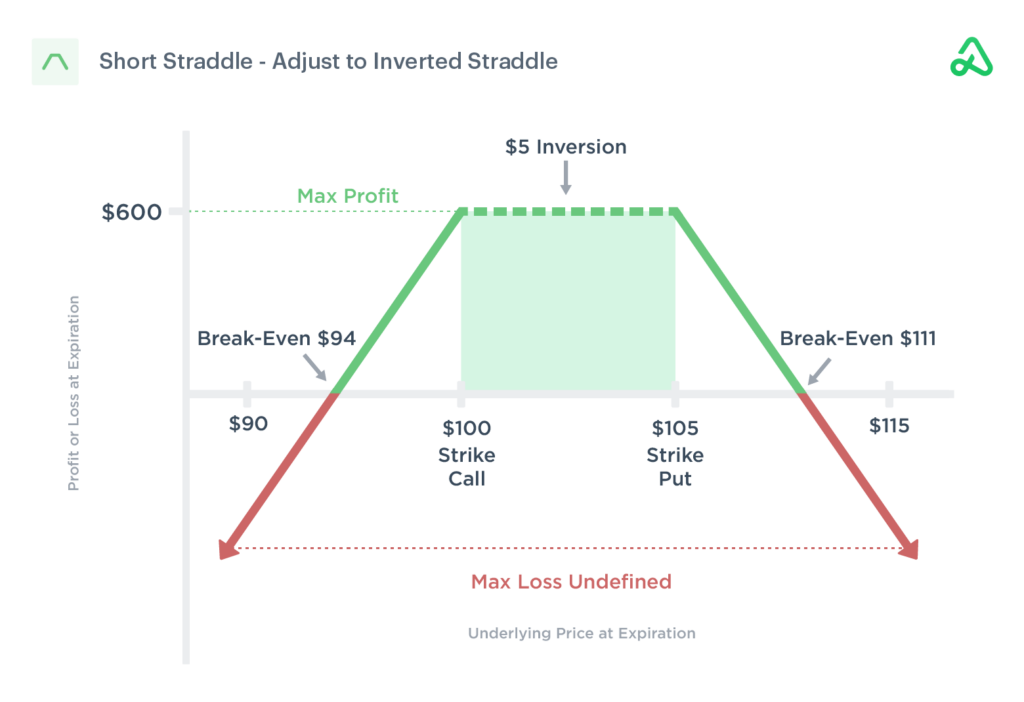

Iron butterflies can be adjusted to extend the time horizon of the trade or by rolling one of the spreads up or down as the price of the underlying stock moves. If one side of the iron butterfly is deep-in-the-money as the position approaches expiration, an investor has two choices to maximize the probability of success.

The entire position can be closed and reopened for a later expiration date. Iron butterfly options adjustments typically brings in more credit, which may widen the break-even point, increase the maximum profit potential, and decrease the maximum risk, depending on the adjustment strategy. Contract size and expiration dates must remain the same to maintain the risk profile.

If one side of the iron butterfly is challenged, the opposing short option could be rolled toward the stock price to receive additional credit. The additional credit will widen the break-even point on the challenged side of the position and reduce risk if the stock does not reverse.

However, because iron butterflies are centered at the same short strike price, adjusting a short option results in the position being “inverted,” meaning the short call is below the short put. When inverted, the distance between the call and put options will be the least amount the position can be repurchased. If the credit received from the initial entry plus the credit received from the inversion is wider than the width of the inversion, the position may result in a profit.

For example, an iron butterfly centered at $100 with a $10 wide spread received $5.00 of credit at trade entry. If the underlying stock price increases, the short put could be rolled up to $102. This would create a $2 inversion.

- Buy-to-close: $100 put

- Sell-to-open: $102 put

Assuming the adjustment brings in an additional $1.00 of credit, the maximum profit potential becomes $400 if the stock closes between $100 and $102 at expiration, because the spread could be purchased for no less than $2.00.

If the stock continues to rise, the risk to the upside is reduced. However, if the $90 long put is not rolled up, the downside risk increases by $200 per contract because the spread between the short put and long put is wider.

Iron Butterfly adjust to to inverted butterfly

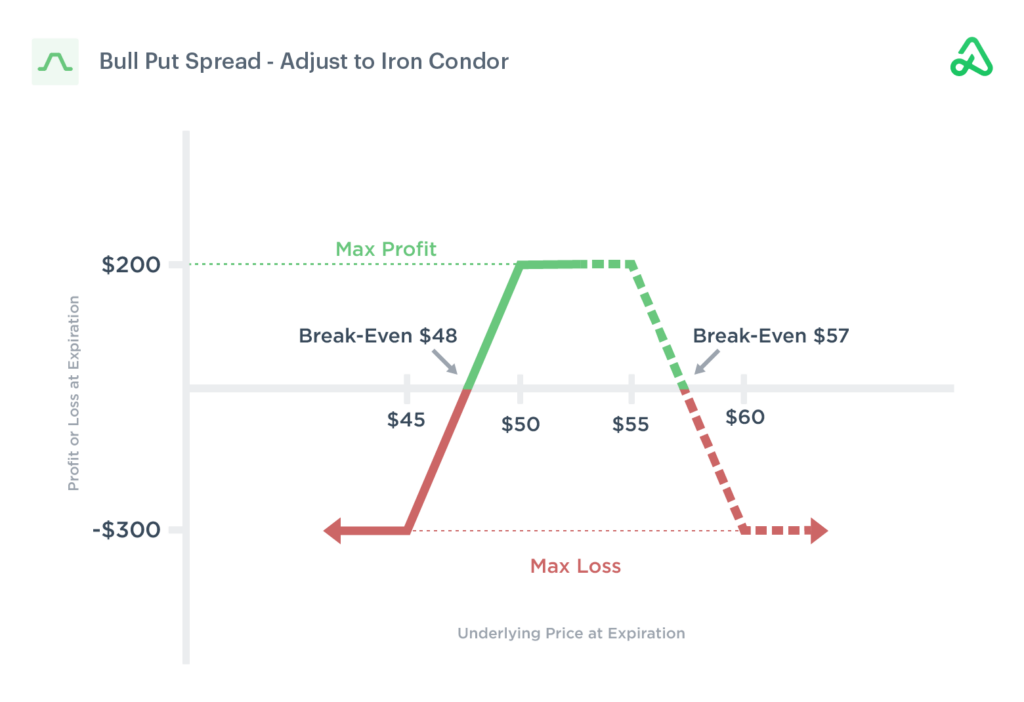

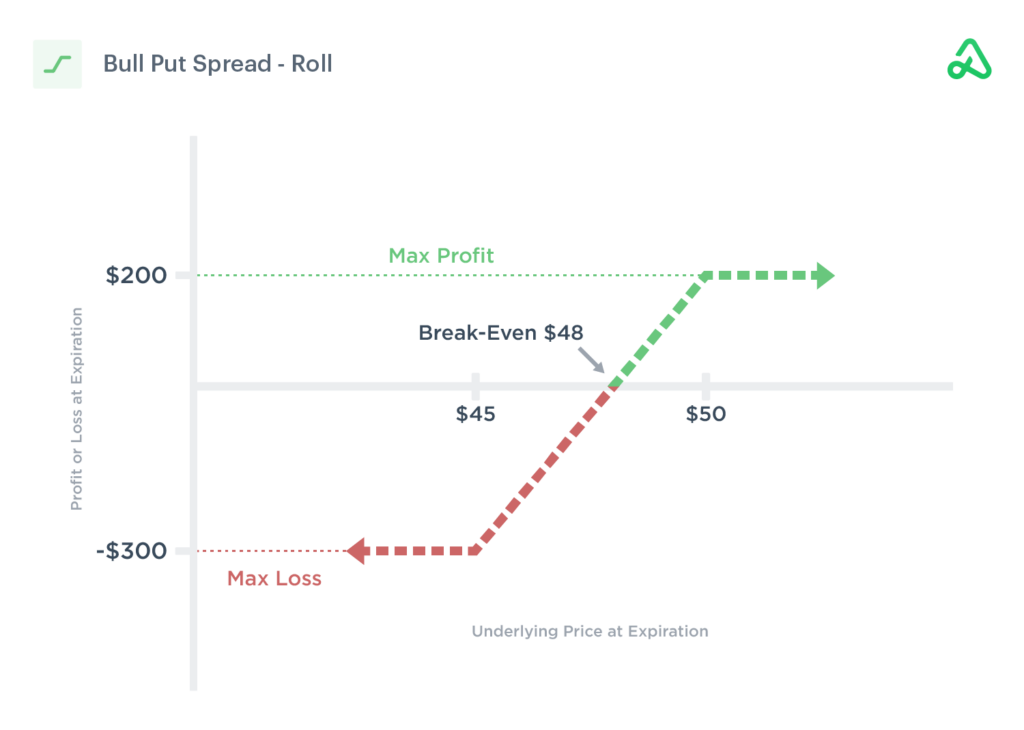

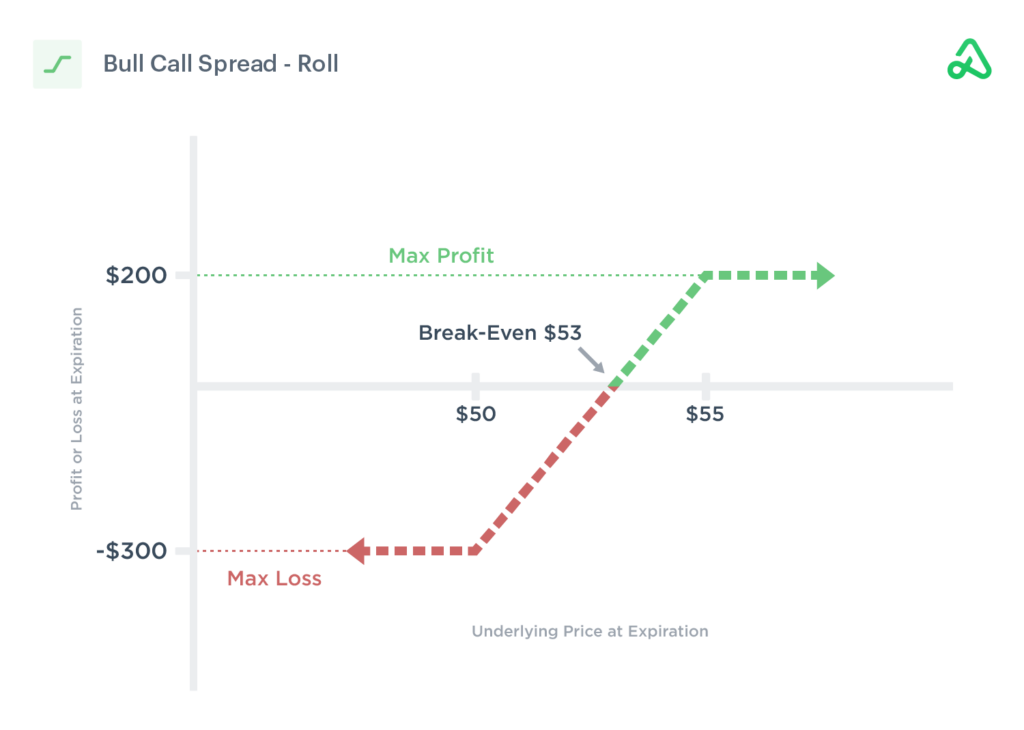

Rolling an Iron Butterfly

Iron butterflies can be rolled out to a future expiration date to maximize the potential profit on the trade. Time decay benefits options sellers. If expiration is approaching and the position is not profitable, the original iron butterfly position may be purchased and resold for a future expiration date. This may result in a credit and will extend the trade’s time duration and widen the break-even points.

For example, if the original iron butterfly is centered at $100 with a June expiration date and received $5.00 of premium, the investor could buy-to-close (BTC) the entire position and sell-to-open (STO) a new position in July. If this results in a credit of $1.00, the maximum profit potential increases and the maximum loss decreases by $100 per contract. The new break-even points will be $94 and $106.

Example of rolling an iron butterfly out to a later expiration date

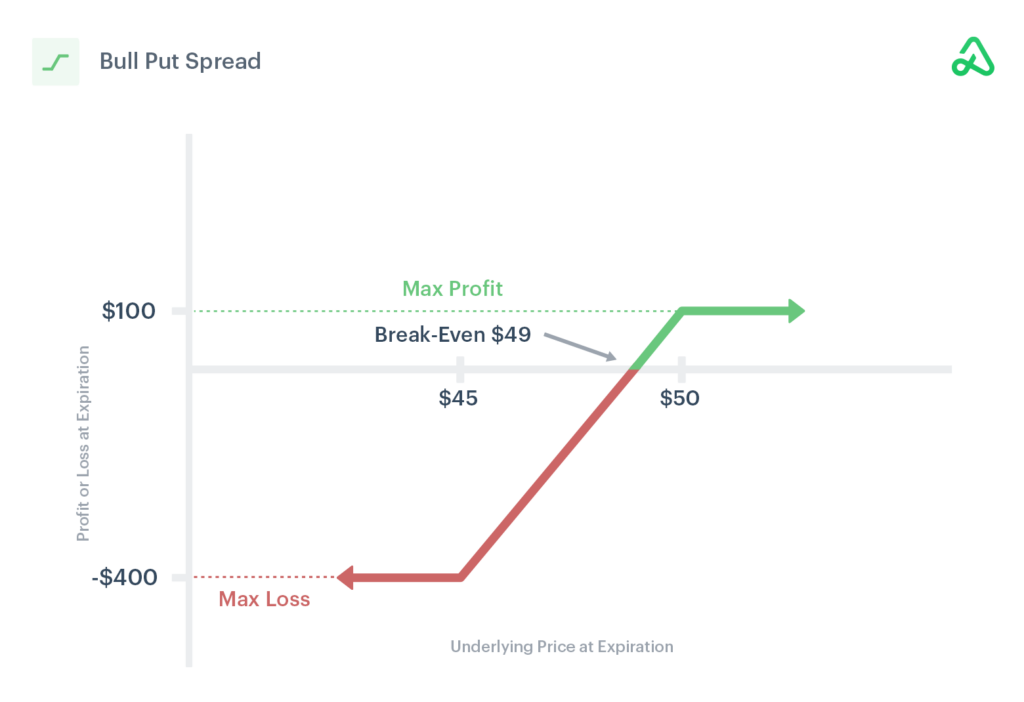

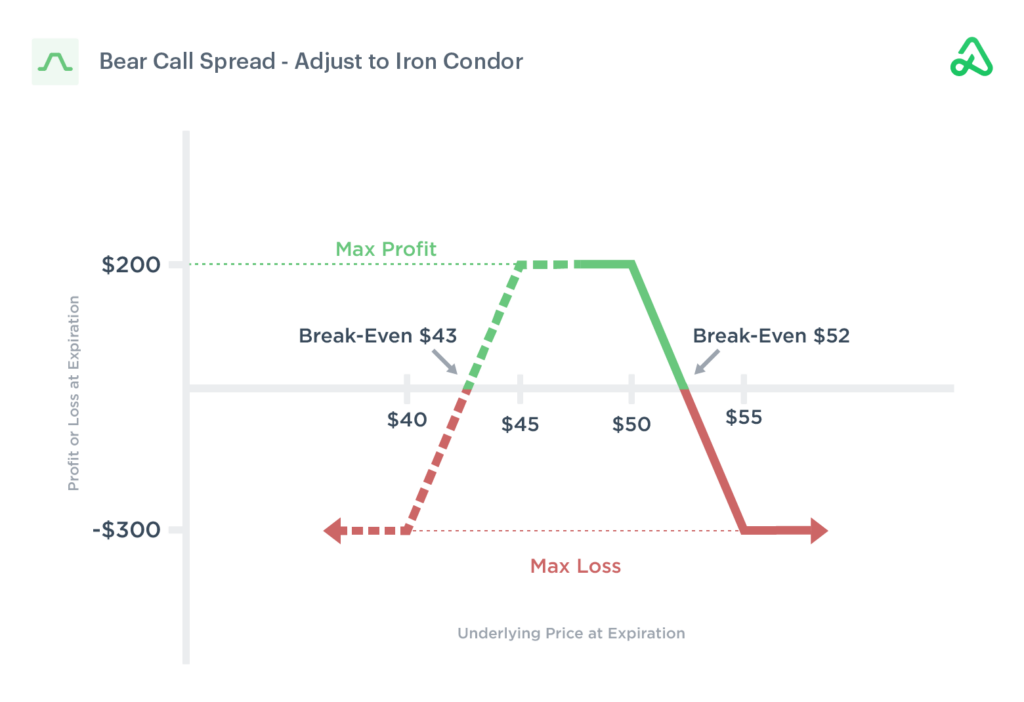

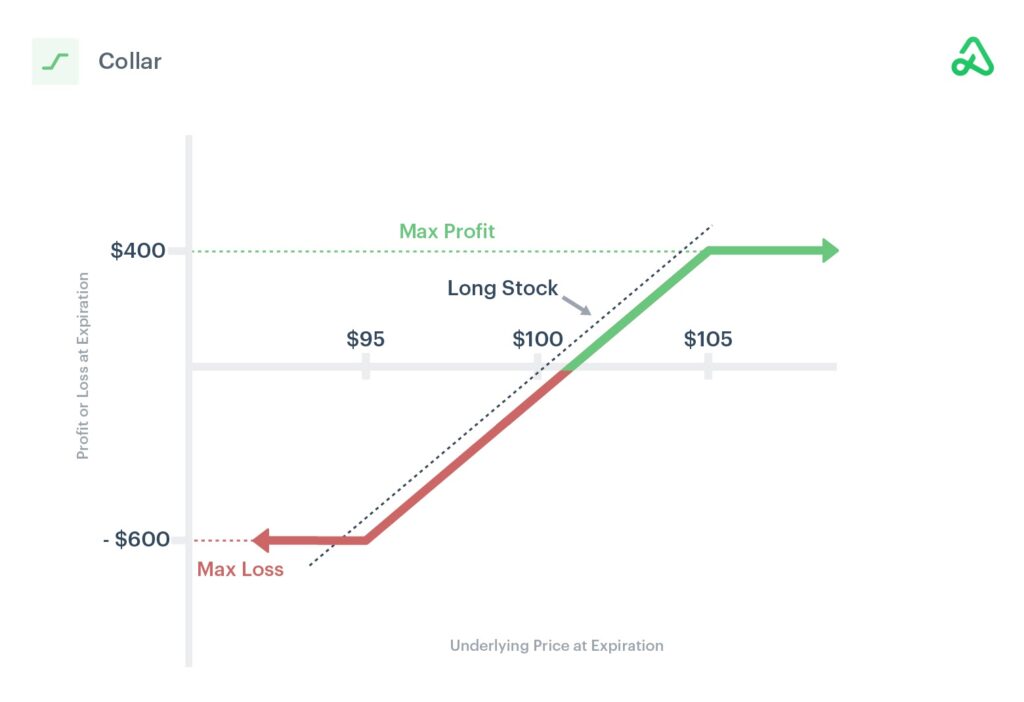

Hedging an Iron Butterfly

The most efficient way to hedge an iron butterfly is to roll the unchallenged spread in the direction of price movement.

For example, if the price of the underlying stock has moved higher and is challenging the bear call credit spread, the original bull put credit spread could be closed and reopened closer to the current stock price. This will increase the amount of credit received, and if the price of the stock continues higher, the bull put spread will remain profitable, while the bear call spread will lose money.